Overcoming Cash Flow Challenges: The Innovative Approach of Leading Edge Commercial Capital

As a proactive business owner, you understand the value of a healthy cash flow to the sustainability and growth of your business. However, dealing with unpaid invoices and delayed payments can significantly affect this much-needed cash flow. Leading Edge Commercial Capital invites you to explore the sustainable solutions that effectively reduce the burden of unpaid invoices.

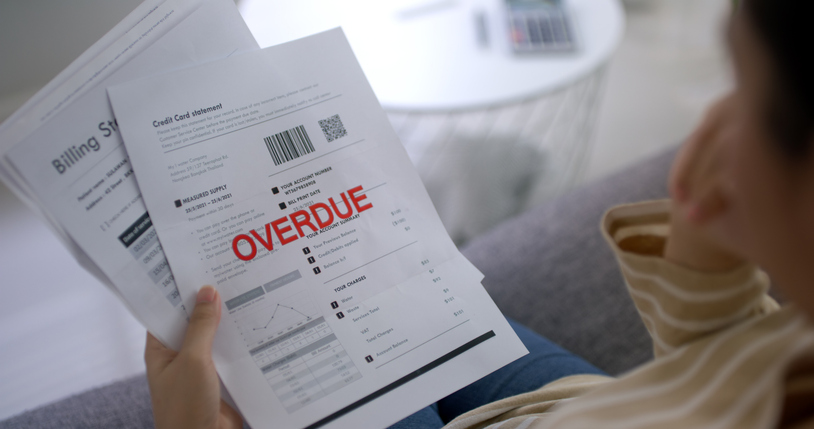

So, what’s the issue with unpaid invoices?

Unpaid invoices can cause a cash flow crunch, whereby you’re unable to meet your financial obligations or even reinvest in your business. What’s worse, you end up spending precious time and resources on collection efforts, detracting from your core business activities. Simply put, aging receivables can stunt the growth, development, and even survivability of your business.

The Leading Edge Commercial Capital Solution

Leading Edge Commercial Capital is dedicated to assisting businesses combat this common issue. We offer a progressive procedure, known as invoice factoring, that aids businesses to convert their unpaid invoices into immediate cash.

With this innovative strategy, you can transform your company’s financial landscape without the need for traditional bank loans. Invoice factoring is not a loan, but rather a way of selling your company’s unpaid invoices at a discounted price to us. We then take on the task of collecting payment from your customers, leaving you to focus entirely on your business operations and growth.

This approach offers a practical, efficient solution for businesses struggling with late payments or non-payment from customers. It helps maintain your company’s liquidity, allowing you to meet operational costs and further invest in your enterprise’s success.

Why Choose Leading Edge Commercial Capital?

When you partner with Leading Edge Commercial Capital, you’re investing in your business’s future. Our team of experts works with you, providing a tailored solution that aligns with your business model and financial requirements. Invoice factoring with us offers fast access to funds, reduced stress from collection efforts, operating flexibility, and a strengthened cash flow.

Moreover, we do all this while maintaining the utmost levels of confidentiality and integrity, ensuring your business relationships remain strong.

Take the Leap!

Let us help you break free from the shackles of unpaid invoices and cash flow issues. Harness our innovative cash flow solutions and pave the way for your business’s growth and success. With Leading Edge Commercial Capital, fast access to cash from unpaid invoices is not just a dream but a reality!